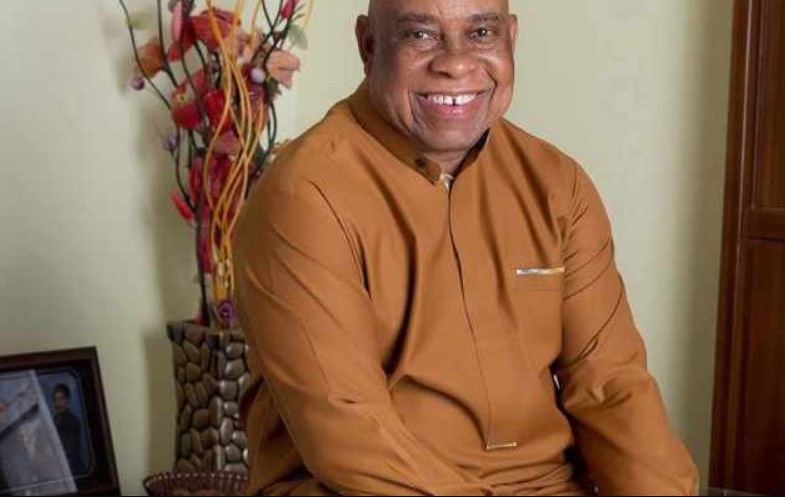

The Chief Executive Officer and Founder of one of Nigeria’s leading NGO microfinance institutions, Grooming Centre, Dr. Godwin Nwabunka, spoke with Nduka Nwosu on the growth of the industry and how it is adapting to national and global demands. Excerpts:

What is the over-arching philosophy behind Grooming Centre?

Grooming Centre is anchored on a philosophy of service, not wealth acquisition or primitive capitalism as they call it. The Centre is committed to providing solutions, empowering people, growing people and showing that above all, that a national institution can do good and pursue best practices. In a sense we are set out to show that good things can happen in Nigeria, and you do not need anybody to look over your shoulders to do the right thing

A lot of times when stakeholders come to see what we are doing, they are surprised and would ask: where did you get this idea from? Having travelled all over the world, being opportune to go from the North to the East and from the East to the West; Europe, America, Asia, virtually round the world in the course of duty, my team and I have seen beautiful things and outstanding initiatives. So, we brought these ideas back home, to replicate these things with some local adaptation as it would suit our environment, and people think it is a strange thing that Nigerians can be doing something good like it happens elsewhere.

What you have here is a very proud Nigerian institution, a very proud Nigeria initiative. That is what we are striving to achieve in all our endeavours, to raise the flag of Nigeria high. To engender best practice, we continuously evaluate our operations and impact from within and outside. We have done seven global ratings. We have emerged gradually from a beta-rated to an alpha rated institution. We are a global tier one institution in terms of our ratings. We were also the first institution in Sub-Saharan Africa to obtain the Client Protection Principles certification from the SMART Campaign. We became the first institution to be revalidated on the same certification two (years) ago. We have now done two validations; we just had our second validation as a gold rated client-centric institution. This is the verdict of MicroRate, a specialist global microfinance rating agency.

We have done over 12 million credits and now we have over 700,000 clients, mostly women. The bottom of the pyramid is huge. Nigeria’s population is close to 200 million and most of them are at the bottom of the pyramid, including young people.

We started as a one branch operation at Ejigbo, but we have grown and scaled over the years. The 30 women we recently celebrated are just a few of our members that are doing wonderful things, amazing things. Most of the time when you talk about women who are making changes or those who are making impact, you look at the top guys around Ikoyi and Victoria Island, in Abuja and the highbrow places in the country.

No, we are talking about women who are basically starting life from nothing, doing the little things and then turn it into amazing things. They empower themselves; they economically grow their businesses. They empower their families; their children can go to school; they build houses and begin to impact even communities very positively; they become more confident and dignified.

Is micro credit enough to empower these traders and artisans?

Microcredit is just an entry point of financial and economic empowerment. Beyond that, by giving this individual access to credit, you build hope and confidence. Her business grows, contributing to income growth at household level. It is really in the attendant effects. We asked a vital question on why a child who should be in school is hawking? The answer is rooted in poverty. If you want to deal with poverty, you must improve the livelihood of the family at the income and credit levels. You provide them the money to do business, which in turn empowers them to do other things. By increasing income levels, there’s a greater likelihood that their children can keep going to school, taking them off the road and giving them and a promising future. If you help her and she is now able to contribute to the health of the family, what does that do? It reduces child and infant mortality. Her home is much better, sanitation improves, healthcare improves, everything improves, just by providing that access to credit. There is a whole network of benefits you can trigger by giving credits especially to women.

In addition, we also provide non-financial services bundled with access to credit. Business advisory, sensitization to improve health seeking behaviour, nutrition and prevention of communicable diseases, for example.

What is unique about Grooming Centre in terms of vision, strategy, and luck?

Again, you cannot isolate any one thing. However, real passion and desire to drive impact is especially important. Knowing what you want to do in terms of strategy and capacity, knowing what works and what does not work are very important; the team and the methodology you put in place are important. Then good fortune, timing and the grace of God, of course, completes the act. Then everything comes much better together than you had envisaged. We did that very well while I was at the UN where I was the focal point for managing a programme called MicroStart and micro-credit activities. That gave me the opportunity to travel very broadly across the continent, Asia, and Latin America, seeing what the best practices were. Based on these, we were able to learn what works and what does not work. What we did was to align ourselves with those who have done it well. We don’t need to reinvent the wheel. We learned, we made friends, we networked, and we brought them in to help us kick start the business. When we went to work, they helped us to build along the way, some even providing funding, which is important to grow the business.

At the time your partners came in, was it with a different notion of what the Centre was all about?

We had a common understanding with regards to bringing about change by working to fight poverty, by empowering the ordinary hard-working person down the street.

At the beginning, we received a lot of technical assistance from the Association for Social Advancement (ASA), which is also a non-for-profit organisation. Locally, we also received a lot of early assistance from Dr. Godwin Ehigiamusoe and LAPO, the largest microfinance bank in Nigeria. Since then, we have worked with different microfinance investment vehicles, bilateral and multilateral organisations, including the World Bank Group, where we were engaged as one of 16 initial partners in the Universal Financial Access Framework in 2016.

So up to a point you drew some inspiration from these guys?

Oh yes, very much, particularly from ASA.

Are your business activities stretched to the North?

Yes, however, it is for now confined to some states and zones because of issues of insecurity. We are not in the Northeast operationally, but we support other NGOs such as Sesor Empowerment Foundation on an annual basis and recently, the UNHCR to provide humanitarian support in the region.We are in Kano, Kaduna, Plateau, Nasarawa, Niger; our outreach currently spreads to 26 states and the FCT.

Can it be said the Centre is heavy on Corporate Social Responsibility (CSR)?

Yes.We operate a triple bottom line – social, environmental and financial sustainability. Part of our social and environmental commitments mean giving back to the communities we operate in and employ people from. We have diverse programmes – the Lady Kate Okafor Scholarship, which provides scholarships for 1000 children of our members at senior secondary school level annually. We also have the University Grant Scheme, providing 150 grants a year to support research in enterprise and community development at undergraduate and postgraduate level. One of our programmes that is dear to my heart is the Grooming Talent Hunt, which we started in 2019 to provide a platform for young people in Ejigbo, where our Head Office is located. It has now grown to a massive production, with over 500 applicants from across the country annually showing their skills and talents in diverse areas. There is so much talent in this country, and we all just have to find ways of providing opportunities for the next generation to excel. We also do a lot of work with partners in health sensitisation, as I earlier mentioned – improving health seeking behaviour, nutrition and lifestyle enhancement, prevention of diseases – especially Lassa fever and more recently, CoVID-19. Apart from our contributions to CACOVID and the Lagos State government, we focused on providing information, face masks and sanitizers to those at the bottom of the pyramid, especially as they still needed to work and trade right after the lockdown in 2020. We’ve done so many other interventions over the years – building the Apakiimo Centre for Senior Citizens in Oke-Ila, Osun State to provide physiotherapy and psychosocial support, building classroom blocks and providing tuition for students in Abolarin College, Osun State, and providing support for facilities like e-libraries and science laboratories to schools like St. Francis Idimu, St. Peter’s Amizi, and so many others – local sports tourneys, community outreaches, medical drives etc. Our focus is still oriented to the bottom of the pyramid. For social impact to be effective, you also need a sustainable financial arrangement that brings in the funds.

Why is the inability of beneficiaries to respond to loans payment very insignificant at the Centre?

Women make up 99 per cent of the beneficiaries of our credit facilities – and they are more reliable with repayments, as our experience and global studies have shown. They borrow and invest the facility in their businesses. They are very sincere and prudent investors. The surpluses or profits from their investments will go to caring for their families or their children and all kinds of positive endeavours. It is a known global fact that women are good credit managers and investors. Our women constitute a major segment of our clients; that is why our recovery rate has continued to be above 90 per cent. We also employ a very client-centric approach to our service design and delivery. Feedback from the members is very important to us – we continuously engage them through focus group discussions, assemblies, and with outward calls from our 24 hr toll free line. The information we receive from them is very valuable for meeting their needs and preferences, which in turn ensures they use our services for things that generate value for them.

Why do you place so much emphasis on teamwork at Grooming Centre?

Life is a learning curve; every stage of life is about learning with leadership and work experience as part of the process. I am a strong believer in teamwork, in clear definition of roles, so that every member of the team knows what is expected of that person. I have always been driven by that kind of team cooperation, looking beyond your own role but trying to see what you can do to enhance the outcome of the overall team. That has been the way I would describe my philosophy of working in teams. Grooming Centre drives the same process by clearly defining the outcomes you want, assigning roles properly, ensuring that the capacity building, structure and resources that you need to achieve those processes are given; then in terms of recognition and motivation, make sure that it is the best that get motivated.

How do you define the Grooming Centre open door policy?

As a leader, I have created an open-door environment so that people can come in and talk to me. By doing that, coupled with our HR policies and mechanisms, we try to foster an open and transparent working environment. You can even see our offices are open plan, and have glass partitioning, if need be, again to reinforce transparency and openness. I do not close my doors, and nobody closes his or her doors processes for conflict resolution are there. If we get stuck at one point, you go to the other point. If one person is not responding you do not get stuck, you go to the other point. By building these systems, you find out that things will grow with minimum constraints. Another mechanism that is very important to us is the succession planning, at governance, management and all levels of staffing. You must be futuristic in terms of your leadership approach and make sure you are thinking about what the enterprise will be, say in the next five years, in the next 10 years or in the next 20 years. We are already building a Grooming Centre compliant with the challenges of the future, the challenges of tomorrow.

Can you further explain what you call the bottom of the pyramid theory and how it fits into the Grooming Centre and its activities?

Like I said, that is where the future lies, it has a whole lot of power and the inability of policy makers to recognise this leads to failure in many ways. This is because the bottom of the pyramid is where things happen. Regardless, a good policy environment will promote it and expand and multiply its positive impacts. But again, regardless of the situation, the bottom of the pyramid survives because it is dealing with the most basic and fundamental needs of life. No matter what happens you must eat, right? And if the supermarkets are closed, you will go to the nearest market and buy something. If the market is closed, you will go to your next-door neighbour’s shop to purchase your needs. Who takes care of those needs? Those at the bottom of the pyramid activities do.

That Mama Iyabo, that Mama Chidi who are next door neighbours or having a shed or kiosk down the road selling rice and beans in modules, and cups, are essential workers or traders who ensure people must eat food, right? Most of us cannot do without them. When people are sick, you must buy Panadol. It is either you are buying from the big pharmacy, or you are buying it from that chemist next door. Even if you are not buying, you are buying it from that guy, that nurse, who is selling it from their homes.

If you drive a car, and your tyres go down, you will need a vulcaniser. You will need to drink water no matter what. If there is no water, that mai ruwa that is a water vendor will deliver it to you with his wheelbarrow. You are dealing with the most fundamental issues that keep life going. Now, good inclusive policy can enhance all of this. Trade is such an essential activity that even when people are displaced and find themselves in a refugee camp, buying and selling go on because people must meet basic needs to survive. Small businesses are the key to driving the economy; while the big businesses are growing, it is the small ones that are supporting them with basic inputs. In such industrialised economies as China, specialisation is a given. A family unit can specialise in the manufacture of nuts while another is known for bolts. It goes on and on like that and collectively they constitute the bottom of the pyramid that feeds the big corporations or manufacturers with their basic products.

And in areas where there is specialisation, one environment is known to produce screws for example or the making of a particular item that goes into the production of the total product such as a car or an aircraft. They make the spokes and supply to the bigger manufacturer that in turn supplies to the big assembly plant, all of which constitute the value chain in the production process.

The national banks don’t just come within the confine of microfinance.

Everything I am talking about now is all about microfinance. I am not talking about conventional banks. You have a unit bank; there are state banks that operate within a state and then national microfinance banks that operate anywhere in the country. You have the big ones, like LAPO in the category of a national microfinance bank. The Police microfinance bank is a national bank. Let me ask you, what is the digital boundary of each of these banks? If you have a unit bank and you have a digital platform that can disburse money to people anywhere in the world because there is no boundary, what is the difference in real terms and how are you going to hold them responsible for working within a local government?

A digital platform can go anywhere because technology is breaking boundaries. You have a unit bank platform such that while you are in the UK, you can do the transactions such as transferring money to your mother without breaking the rules that define your boundary, an artificial one at that.

Innovation in the digital space allows you to do anything from anywhere and at any time, irrespective of time zone. That is why I tell my team; you must play within this space. You must understand the new dynamic, you must see the big picture, step out of your small box and see what is evolving. If you do not do that, you will die. This is because the future does not belong to where you are, the future is moving ahead with or without you. The world has become one small global village without boundaries.